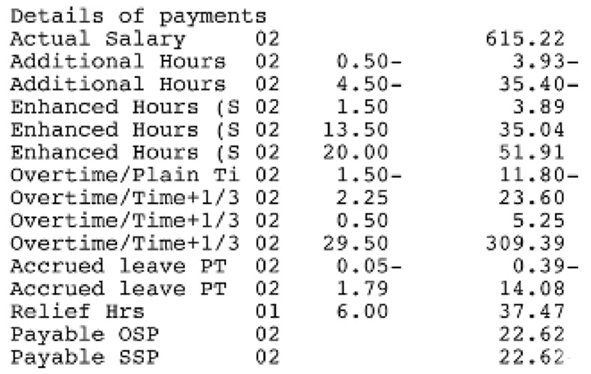

The following example is from a payslip from a member of staff who has 2 jobs.

Actual salary

This is your basic salary, the pay for your contracted hours covering a full calendar month. Any sick pay on your payslip should be added to the actual salary then multiplied by 12 to get your annual salary.

If you have more than one job the salary for each post is shown separately as actual salary (01), actual salary (02) etc, each with a separate employee number.

Payment of actual salary is for the whole month, in which you are paid, for example September payslip relates to your actual salary for 1 to 30 September. The amount shown on your payslip is your annual salary divided by 12. This remains the same even though the number of days in the month may change.

Contracted hours

To calculate your contracted pay for the month you will need to multiply your weekly hours by 52.14 and divide by 12. For example - 20 (hours per week) x 52.14 (weeks per year) + 12 (months) = 86.9 (contact for month).

Additional hours

If you are a part-time employee and you have recorded additional hours, these will be shown on your payslip as additional hours – provided they don't go beyond 37 hours in which case they will be shown as overtime.

The hours up to 37 hours will be paid at plain time, any enhancement due is shown separately.

Additional hours are paid according to those entered from the Sunday before payroll lockdown to the Sunday before payroll lockdown.

Additional hours are paid for hours worked over your contract, and are paid at your basic hourly rate. If you work over 37 hours in one week you will receive your time as overtime + one-third.

Bank holidays

If a bank holiday falls on what would normally be a work day, you will be paid for this day in your salary.

If you are then required to work, you should claim these hours as additional hours (part-time employees) or overtime (full-time employees).

However, if the hours worked are in excess of your normal working hours, they are additional to your contracted hours and will be shown as overtime – double time.

For part-time staff, this may be shown as additional hours and enhanced hours.

Enhanced normal hours

If a bank holiday falls on what would be your normal working day, you will receive the time again at your basic hourly rate as enhanced normal hours.

Overtime double time

Overtime/double time is paid at double your basic hourly rate, for a bank holiday worked where the hours are in addition to your planned working.

Enhanced hours

This will be the hours worked where an enhancement is payable. The plain time part of this pay is already included in your actual salary.

If you have more than one job, the enhanced hours will be shown against each post (01) (02).

Enhanced hours are paid at one-third of your basic hourly rate. For example, E6.90 + 3 = E2.30 multiplied by the hours worked.

Enhanced hours are paid according to those entered from payroll lockdown to payroll lockdown. This date is usually around the 15th of each month. To be certain of each lockdown date please contact your manager.

For employees whose work schedules attract regular enhancements, there enhanced hours will be split over 2 payslips. For example, an employee is entitled to 161.5 enhanced hours for August. The employee will be paid 68 enhanced hours for shifts worked up to lock down on August's payslip and the remaining 93.5 enhanced hours will be paid on September's payslip.

Overtime

If you are a full-time employee and work over your contracted hours, or a part-time employee who works in excess of 37 hours and have worked overtime this will be shown on your payslip as 'overtime – time and a third', or 'overtime – time and a half' depending on your conditions of service.

Overtime + one-third is paid for hours worked over 37 hours in one week. These hours are paid according to those entered from the Sunday before payroll lockdown to the Sunday before payroll lockdown

Accrued leave

This is payment of annual leave accrued by term-time relief staff or part-time staff who have worked additional hours.

Accrued leave part-time employees

This is payment of annual leave accrued for part time employees who have worked additional hours. Accrued leave is paid on monthly basis at your basic hourly rate.

Accrued leave relief employees

Annual leave for relief employees is accrued over the previous 13-week period. The system looks at the relief hours worked and calculates the amount of leave accordingly. To enable payment for these hours your manager must enter annual leave into the system. Once this process is complete you will see annual leave paid at your basic rate on your payslip.

Relief hours

All hours worked are paid at the hourly rate applicable to the time of day that work is undertaken.

Relief hours are paid according to those entered from the Sunday before payroll lockdown to the Sunday before payroll lockdown. Relief hours are paid at your basic hourly rate. If you work over 37 hours in one week you will receive your time at overtime + one-third.

Sickness payments

Sick pay is shown separately on your payslip as follows:

- Payable OSP – occupational sick pay

- Payable SSP – statutory sick pay

Sickness absence entitlements are calculated based on an employee's length of service.

- first year of service - 1 month on full pay

- after 4 months service - 1 month on full pay + 2 months on half pay

- second year of service - 2 months on full pay + 2 months on half pay

- third year of service - 4 months on full pay + 4 months on half pay

- fourth and fifth year of service - 5 months on full pay + 5 months on half pay

- after 5 years' service - 6 months on full pay + 6 months on half pay

All sick leave will be paid at plain time rates.

When you are on sickness leave from work, your manager will enter your absence into the system. The system will then reduce your actual salary by this amount. You will then see OSP (Occupational Sick Pay) and or SSP (Statutory Sick Pay) crediting you with the amount deducted.

Lettings (caretaker)

If you are a caretaker who opens or closes school property for lettings you will be paid for a minimum of one and a half hours at plain time rates between 7am and 7pm, and time and a third between 7pm and 7am. Hours worked on bank holidays will be paid at double time.

If you are only required to open and close, you will be paid for a minimum of 1.5 hours. Where the letting commences before 7pm the first 45 minutes will be paid at plain time and the remainder at time and a third. If you are required to attend during the letting, you will be paid for the actual hours you work at the appropriate rate.

Travel

You will be reimbursed if you use your own car for your job. You cannot claim for mileage to and from your home.

Standby (craft)

If your job means that you have to be available for contact or response outside normal hours you will be paid a set amount which includes the first half-hour of work. After that normal pay rates or overtime/bank holiday rates will be paid.

Two standby payments will be made for 24-hour cover on a Saturday or Sunday.

Retrospective payments

If an entry on the payslip has a number in the first column, headed MTH, this means the payment related to an earlier month. The number tells you which month it related to:

- 01 = January

- 02 = February

- 03 = March

- 04 = April

- 05 = May

- 06 = June

- 07 = July

- 08 = August

- 09 = September

- 10 = October

- 11 = November

- 12 = December

If there isn't a number in the first column it means the payment related to the current month.

Entries in more than once

If an entry, for example enhanced hours is in more than once, this refers to pay you owe or are owed from a previous month. If this is the case it will display against that month.